Market Statistics Across Canada

November 2025 Comprehensive Market Report

As Canada's real estate markets close out 2025, November data reveals distinct trends across the nation's major markets. From Vancouver Island's continued stability to Greater Vancouver's buyer-favorable conditions, Calgary's market adjustment, and Toronto's price softening, understanding these local dynamics is essential for making informed real estate decisions. This comprehensive analysis examines four key markets representing Canada's diverse real estate landscape.

Campbell River Real Estate Market

Local Market Overview

Campbell River's real estate market experienced typical seasonal patterns in November 2025. The benchmark price for single-family homes sat at $670,400, representing a modest 3% decline from November 2024, but maintaining stability within the broader Vancouver Island market context. With 34 single-family home sales in November—up 3% from the previous year—the market demonstrates steady activity despite the traditional holiday slowdown.

Sales Activity & Trends

- November sales: 34 single-family homes (up from 33 in November 2024)

- October sales: 51 homes (showing typical seasonal decline into winter)

- Month-over-month change: -33% (consistent with normal seasonal patterns)

- Market conditions remain balanced, favorable for both buyers and sellers

Price Trajectory

Market Position

Campbell River represents one of the more affordable markets within the Vancouver Island Real Estate Board territory, with benchmark prices significantly below regional centers like Nanaimo ($801,900), Parksville-Qualicum ($920,800), and the Comox Valley ($851,000). This relative affordability, combined with Campbell River's strong community amenities, outdoor recreation opportunities, and economic stability, continues to attract buyers seeking Vancouver Island lifestyle at accessible price points.

Regional Context

- Campbell River benchmark 16% below board-wide average of $779,200

- Offers value proposition compared to southern Island markets

- Balanced market conditions provide fair pricing for transactions

- Seasonal patterns consistent with broader Vancouver Island trends

- Year-over-year sales growth indicates sustained buyer interest

Local Advantage: While Campbell River's benchmark price saw a modest year-over-year decline, this adjustment reflects the broader market recalibration occurring across Vancouver Island and maintains the city's position as an attractive option for buyers prioritizing affordability without sacrificing quality of life. The balanced market conditions and steady sales activity suggest a healthy, sustainable market environment heading into 2026.

Vancouver Island Real Estate Market (VIREB)

Market Analysis

VIREB CEO Jason Yochim emphasizes the region's stability: "VIREB's housing market remains relatively stable, with sales sitting just below the ten-year average and conditions at the high end of balanced territory. Although sales of single-family homes, condo apartments and townhouses dipped in November, that's typical for this time of year as buyers and sellers slow down for the holidays." The board maintains approximately six months of inventory, a balanced position that benefits both buyers and sellers.

Single-Family Detached Homes by Region

Property Type Performance

Sales Activity by Property Type

- Single-family homes: 259 sales, down 1% year-over-year and 18% from October

- Condo apartments: 50 sales, down 19% year-over-year and 28% from October

- Row/townhouses: 53 sales, down 29% year-over-year and 32% from October

- Active single-family listings: 1,121 (compared to 1,105 in November 2024)

- Active condo listings: 346 (compared to 314 in November 2024)

Regional Resilience: "While federal measures announced in 2025 aim to boost housing supply, they're unlikely to influence our local market in 2026," adds Yochim. "Despite broader uncertainties, VIREB's market proved more resilient than Vancouver and the Lower Mainland this year, and we expect that stability to continue into 2026." This stability is reflected in the modest price appreciation for single-family homes and strong apartment gains, even as sales volumes follow typical seasonal patterns.

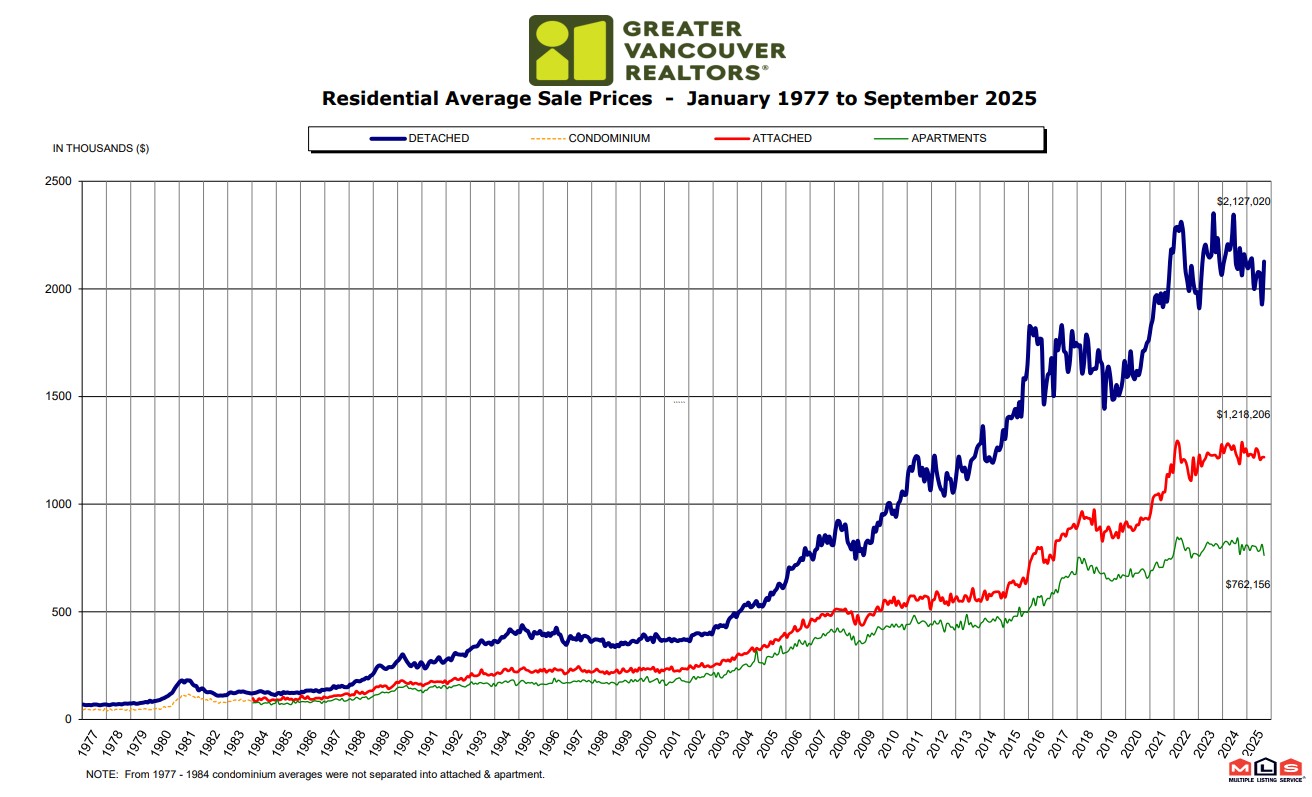

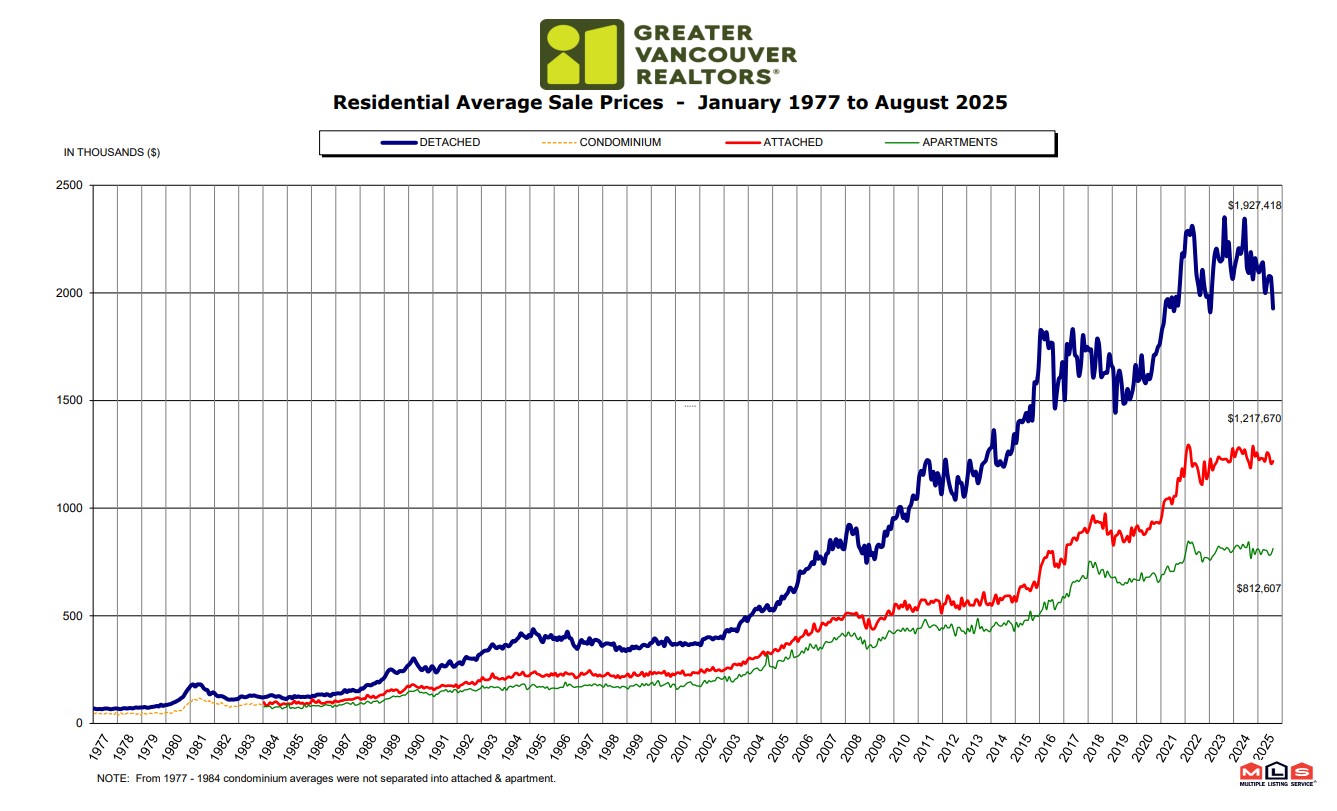

Greater Vancouver Real Estate Market

Market Analysis

Greater Vancouver REALTORS® Chief Economist Andrew Lis describes a market where buyers remain patient and sellers adjust to conditions not seen in years. "Inventory remains healthy, providing buyers ample choice, which, by contrast, is pushing sellers to accept that pricing must reflect this new reality," Lis notes. With the sales-to-active listings ratio at 12.6 percent, the market continues to favor buyers, with downward price pressure persisting when this ratio stays below 12 percent for extended periods.

Property Type Breakdown

November Sales Activity

- Detached home sales: 541 units (-13.6% year-over-year)

- Apartment sales: 945 units (-13.2% year-over-year)

- Attached home sales: 350 units (-22.4% year-over-year)

- Sales 20.6% below 10-year seasonal average

Year-End Outlook: As sales volumes remain subdued and inventory plentiful, properties are taking longer to sell, with pricing continuing to soften across most segments. With borrowing costs likely remaining steady into 2026, any uptick in demand will need to arise from a significant change in buyer sentiment. December is typically among the quietest months for market activity, suggesting a quiet close to a year marked by considerable uncertainty.

Calgary Real Estate Market

Market Analysis

Calgary's market continues its seasonal adjustment pattern. CREB® Chief Economist Ann-Marie Lurie explains: "Supply levels have been sitting higher than typical levels for the past three months, mostly due to the gains occurring in the higher-density sectors of row and apartment style units." This additional supply relates partly to new homes sector inventory, some of which enters the resale market near year-end. While buyer's market conditions prevail for apartments and row homes, detached and semi-detached markets remain relatively balanced.

Property Type Performance

Market Dynamics

- Sales-to-new-listings ratio improved to 69% in November

- Inventory 15% higher than typical November levels

- Detached and semi-detached homes: under 3 months of supply (balanced)

- Apartments: 5.5 months of supply (buyer's market)

- Row homes: 3.51 months of supply (approaching buyer's market)

District Highlights

Market Conditions: The additional supply across resale, new, and rental markets is impacting apartment and row home prices most significantly, with year-over-year declines of seven and six percent respectively. Detached home prices, while down two percent from last November, remain one percent higher year-to-date. Most downward price adjustments have occurred in the North East, North, and East districts.

Toronto Regional Real Estate Market (TRREB)

Market Analysis

TRREB President Elechia Barry-Sproule emphasizes that employment confidence remains key: "There are many GTA households who want to take advantage of lower borrowing costs and more favourable selling prices. What they need most is confidence in their long-term employment outlook." Fortunately, November saw encouraging news on jobs and the broader economy. If this positive momentum continues, consumer confidence will strengthen, positioning more people to consider home purchases in 2026.

Property Type Performance

Regional Breakdown

- City of Toronto: 1,912 sales, $1,036,362 average price

- Halton Region: 545 sales, $1,166,457 average price

- Peel Region: 841 sales, $962,247 average price

- York Region: 893 sales, $1,227,365 average price

- Durham Region: 622 sales, $840,833 average price

Economic Context

TRREB Chief Information Officer Jason Mercer notes: "November reports on employment and economic growth were much stronger than expected. The Canadian economy may be weathering trade-related headwinds better than expected. More certainty on the trade front coupled with positive economic impacts of recently announced infrastructure projects could improve homebuyer confidence moving forward."

Market Conditions

- MLS® HPI Composite benchmark down 5.8% year-over-year

- Seasonally adjusted sales down slightly from October

- Well-supplied resale market currently favoring buyers

- Average days on market: 34 days

- Sale-to-list price ratio: 97%

Construction Focus: TRREB CEO John DiMichele emphasizes the importance of new construction: "Homebuyers are currently benefitting from a well-supplied resale market. However, as this inventory is absorbed, new construction is required to fill the housing pipeline. It will be key to see projects that bridge the gap between condominium apartments and traditional single-family homes."

National Market Summary & Outlook

Key Trends Across Canada

November 2025 reveals consistent themes across Canada's major real estate markets:

- Campbell River offers relative affordability with balanced market conditions and modest year-over-year sales growth

- Vancouver Island (VIREB) demonstrates remarkable resilience with balanced market conditions and modest price growth, proving more stable than the Lower Mainland

- Greater Vancouver continues showing buyer-favorable conditions with healthy inventory levels and price softening across all segments

- Calgary experiences market adjustment with significant excess supply in higher-density housing, while detached homes remain relatively balanced

- Toronto sees continued price declines but improving economic fundamentals that may support future buyer confidence

- Most markets show elevated inventory levels compared to historical averages

- Sales activity remains below both previous year levels and long-term averages in major metropolitan areas

Economic Factors

Several key factors are shaping Canada's real estate landscape as 2025 closes:

- Interest Rates: Borrowing costs expected to remain relatively steady into 2026

- Employment: Stronger-than-expected job growth in November providing cautious optimism

- Economic Growth: Canada's economy weathering trade-related headwinds better than anticipated

- Buyer Sentiment: Confidence remains the key missing ingredient for market recovery

- Inventory: Well-supplied markets providing buyers with ample choice and negotiating power

Looking Ahead to 2026

As December typically brings the year's quietest market activity, attention turns to 2026. Key factors to watch include:

- Trade policy certainty and its impact on economic confidence

- Infrastructure project announcements and their economic ripple effects

- Continued employment growth and wage trends

- New construction supply, particularly in the "missing middle" housing types

- Seasonal spring market activity and whether buyers return in force

Expert Perspective: Across all markets, the consistent message is clear: buyers and sellers are striking deals when their expectations align with current market realities. Campbell River and broader Vancouver Island stand out for maintaining stability and balanced conditions even as major metropolitan markets soften. Campbell River's relative affordability within the Island context positions it as an attractive option for buyers seeking value without compromising on lifestyle. For buyers, this means abundant choice and negotiating power in urban centers, while Vancouver Island markets like Campbell River offer more balanced environments with steady activity. For sellers across all markets, this means pricing properties to reflect today's conditions, not the market of years past. As economic fundamentals slowly improve, the stage is being set for a potential shift in market dynamics in 2026.